In today’s financial landscape, ensuring secure transactions is more crucial than ever, and Chase Bank cashier's checks provide a reliable option for both individuals and businesses. These checks are not just pieces of paper; they represent a promise backed by the bank itself, making them a preferred choice for significant payments. Whether you're purchasing a home, paying for a vehicle, or settling a business transaction, understanding how to obtain and use a Chase Bank cashier's check can streamline your financial dealings.

Chase Bank cashier's checks are also known for their security features and minimal risk of bouncing due to insufficient funds. This reliability makes them a popular choice among buyers and sellers alike, especially in high-stakes transactions. However, navigating the process of acquiring one might seem daunting if you are unfamiliar with the banking jargon or procedures involved. This article aims to unravel the intricacies of the Chase Bank cashier's check, answering common questions and providing you with essential knowledge needed to make informed financial decisions.

From understanding what a cashier's check is to learning how it differs from a personal check, this guide will cover all the bases. Additionally, we will explore the costs involved, the application process, and tips for using your cashier's check effectively. So, if you are ready to improve your financial literacy and ensure your transactions are smooth and secure, let’s dive into the world of Chase Bank cashier's checks!

What is a Chase Bank Cashier's Check?

A Chase Bank cashier's check is a type of check that is guaranteed by the bank itself. Unlike personal checks, which are drawn from an individual's account, cashier's checks are drawn from the bank's funds, making them a safer option for large transactions. The bank takes the necessary amount from the payer's account and issues a check that is backed by the bank's own funds. This ensures that the check will not bounce due to insufficient funds.

How Do Cashier's Checks Differ from Personal Checks?

Understanding the differences between cashier's checks and personal checks is essential when deciding which payment method to use:

- **Fund Guarantee:** Cashier's checks are guaranteed by the bank, while personal checks depend on the payer's account balance.

- **Processing Time:** Cashier's checks are processed more quickly than personal checks, ensuring the payee receives their funds promptly.

- **Security Features:** Cashier's checks often come with additional security features, reducing the risk of fraud.

- **Cost:** There may be fees associated with acquiring a cashier's check, while personal checks typically do not incur such costs.

How Can You Obtain a Chase Bank Cashier's Check?

Obtaining a Chase Bank cashier's check is a straightforward process, but it does require you to follow specific steps:

- **Visit a Branch:** Head to your nearest Chase Bank branch. Cashier's checks cannot be obtained online.

- **Provide Identification:** Bring a valid form of identification, such as a driver's license or passport.

- **Specify the Amount:** Inform the bank representative of the amount you need for the cashier's check.

- **Pay Any Fees:** Be prepared to pay any associated fees, which may vary by location.

What Are the Costs Associated with Chase Bank Cashier's Checks?

While cashier's checks offer many advantages, it’s essential to be aware of the costs involved:

- **Fee Structure:** Chase Bank typically charges a fee for issuing a cashier's check, which can range from $8 to $10 for account holders.

- **Non-customer Fees:** If you are not a Chase Bank customer, the fee may be higher, so it's best to check ahead.

- **Additional Charges:** There may be extra charges for expedited services or other special requests.

What Security Features Do Chase Bank Cashier's Checks Have?

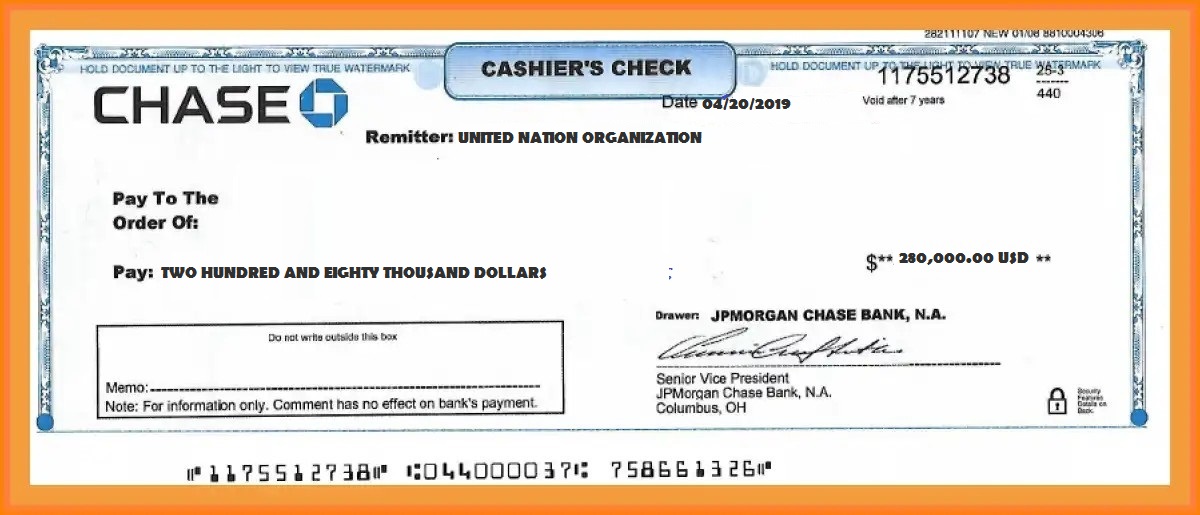

Security is a paramount concern when dealing with large sums of money. Chase Bank cashier's checks come equipped with various security features designed to prevent fraud:

- **Watermarks:** Cashier's checks often feature watermarks that are difficult to replicate.

- **Microprinting:** Small text is used on the check that can only be seen with a magnifying glass.

- **Color-Shifting Ink:** Some checks may use ink that changes color when viewed from different angles.

Can You Cancel a Chase Bank Cashier's Check?

Once a cashier's check is issued, the funds are guaranteed, and it is generally considered a final payment method. However, there are circumstances under which you may be able to cancel a cashier's check:

- **Lost or Stolen Checks:** If your cashier's check is lost or stolen, you can request a stop payment at the bank.

- **Fraudulent Activity:** If you suspect fraud, you have the right to report it and take action.

- **Uncashed Checks:** If the check has not been cashed, you may be able to request a refund after a specific period.

What Should You Do If Your Cashier's Check Is Lost or Stolen?

If you find yourself in the unfortunate situation of having lost or had your Chase Bank cashier's check stolen, here are the steps to take:

- **Report to the Bank:** Notify Chase Bank immediately about the loss or theft.

- **Complete Required Forms:** Fill out any necessary forms to report the incident and request a stop payment.

- **Provide Identification:** Be prepared to provide identification and, if possible, any details about the check.

Are There Alternatives to Chase Bank Cashier's Checks?

While Chase Bank cashier's checks are a reliable option, several alternatives might suit your needs better:

- **Money Orders:** Typically used for smaller amounts, money orders can be obtained from various locations, including post offices and convenience stores.

- **Bank Transfers:** Electronic transfers are becoming increasingly popular for their speed and convenience.

- **Wire Transfers:** For significant transactions, wire transfers offer a secure and fast method of transferring funds directly from one bank account to another.

In conclusion, understanding the ins and outs of Chase Bank cashier's checks can significantly enhance your financial transactions. These checks provide a secure, reliable method of payment, essential for significant purchases and business dealings. With the knowledge gained from this article, you are now equipped to navigate the process of obtaining and using a Chase Bank cashier's check effectively.